As technology adoption became the default advice for small and medium enterprises to remain competitive in the digital economy, Christopher Choo and Frank Zhao knew exactly the barriers preventing these businesses from embarking on a digital transformation: high cost of investment, and complex systems.

Chris first encountered a small business’ struggle in technology usage at his aunt’s shop in late 2018. While waiting to pay for his item, he noticed that the customer before him was taking unusually long for her transaction. His aunt had resorted to tallying the purchases with pen, paper and a calculator to track the prices and discounts.

“I was surprised that my aunt didn’t use a point of sales system (POS). Like any regular customer, I thought having a POS is part of a regular retail set-up. My aunt told me that a standard POS system can easily cost over $10,000 at start. This is simply too daunting for a small shop like hers. She also mentioned how she might fumble in operating a POS machine, which could get quite complex,” shared Chris. He left the shop with his new purchase, and a nagging thought – to find out if his aunt’s issue with the existing POS solutions in the market was indeed a prevalent challenge for small businesses. And it is.

Meanwhile, Frank, who had just spent a two-year stint in Beijing, China, returned to Singapore with the idea of creating integrated payment systems that could make POS retail transactions truly cashless and convenient. He was inspired by China’s success with e-wallet solutions and wanted to explore how Singapore could do the same.

Frank explained, “Ever noticed how merchants need to use different terminals for different modes of payment at the counter? Leasing different payment terminals for credit and debit cards, e-wallets, and more, adds to the business cost. It also imposes demands on the merchants to learn the management of multiple systems.”

The Birth of Qashier

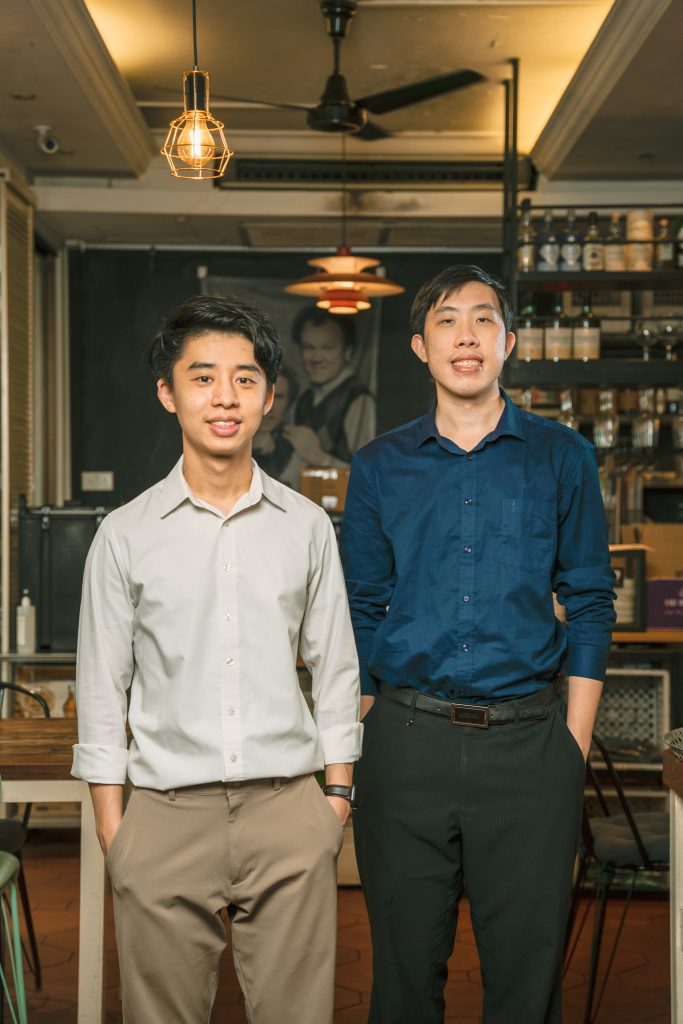

Previously acquainted through a networking event, Chris and Frank reconnected when both of them enrolled in a start-up accelerator programme. By now, the two were focused on exploring opportunities in revolutionising POS and payment solutions offered in the market. They shared their ideas with each other and recognised how the gaps they had respectively identified are two sides to a coin.

With their goals aligned, Chris and Frank founded Qashier in February 2019. They set their sight firmly on creating business solutions that are accessible, customisable and easy-to-use. Chris elaborated, “Our value proposition is anchored on levelling the playing field for small and mid-size businesses by providing them with POS solutions that enhance their capability to do more. The lack of capital should not be the reason preventing them from having access to technology that the big boys can easily deploy. We implemented a subscription model to make owning a POS system highly affordable, and it starts from as low as $1 a day.”

Qashier’s POS solutions are also scalable, allowing merchants to pay only for features they need while having the flexibility to scale up as their business needs expand. Above all, Qashier’s technologies are easy to adopt. The POS terminals are plug-and-play, and the navigation between different features is highly intuitive. The need to have different payment terminals at the counter is also a thing of the past as Qashier integrates various payment modes to a single device.

Getting the First Client

With Qashier’s first POS prototype in hand, Chris and Frank went door to door to small shops, eager to demonstrate how the nifty terminal packs a punch. After being turned away by several uninterested shop owners, they finally found an audience in the owner of a nail parlour who spent two hours discussing his business pain points. Chris and Frank listened intently and took notes. While the prototype already incorporated essential features of a good POS system, they took up the challenge of developing a customer loyalty component to help the nail parlour easily track service packages that customers purchased. Pleased with the solution, the nail parlour owner was sold. Qashier won its very first deal within 2 months of its incorporation.

Looking back, Chris and Frank are grateful for the merchants who took a leap of faith to adopt Qashier POS solutions before they had any success stories to share. “The blueprint for our solutions is built upon empowering businesses to grow, regardless of how small they may start. These merchants gave us a vote of confidence and a track record which helps us reach out to a wider base of prospective clients. Our journey thus far is only possible because of our clients’ success.”