Qashier triumphs with two awards for Fintech categories at Singapore and Malaysia Technology Excellence Awards 2024

The company continues to set standards in the fintech space…

The company continues to set standards in the fintech space…

The company continues to set standards in the fintech space…

In the pursuit of customer retention, a golden rule is to prioritize your customers’ needs. Are you currently offering personalized payments for your customers to enhance their shopping experience?

For instance, Jenny, a young professional, seeks a fitness tracker. She finds one online but faces limited payment options at checkout—credit card or bank transfer only. Without a credit card and finding bank transfers cumbersome, she abandons her cart without hesitation.

What is the secret to maximizing personalized payments? It is leveraging data to understand your customers’ preferences. By analyzing demographics, location, and past purchase behavior, your business can anticipate customer needs and tailor a personalized payment that resonates.

In Southeast Asia’s booming digital market, understanding customer preferences ensures inclusive and seamless payment – a critical factor for business success. It drives:

Moreover, understanding customers involves ensuring financial inclusion, which is crucial in regions like Southeast Asia with limited digital banking. Offering diverse payment options may help:

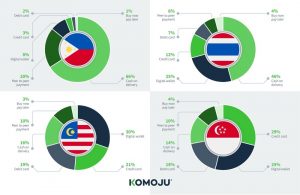

In Southeast Asia, the payment landscape is multifaceted. By 2025, the region is projected to reach 439.7 million active wallets, a 311% increase from 2020, positioning it as the fastest-growing mobile wallet region. E-wallets thrive in the Philippines, Thailand, and Vietnam, expected to surpass cards by 2026.

In the Philippines, cash remains the most preferred mode of payment. But since the 2019 pandemic, cashless payment methods like e-wallets have become popular and more establishments have started accepting digital payments.

Meanwhile, Cash on Delivery (COD) continues to hold its ground in certain countries, especially for social commerce transactions.

Understanding customer payment preferences helps unlock markets, builds relationships, and promotes financial inclusion in Southeast Asia.

While shopping in-store, your customers can enjoy seamless checkout experiences by using their preferred e-wallet or contactless card, avoiding form-filling and long waits.

For online shoppers, QashierPay by Link (available in Singapore, coming soon in the Philippines) offers secure, personalized payments. This unique feature sends a secure payment link directly to customers’ mobile phones or emails, eliminating the need for manual entry. With one click, busy bees who prioritize convenience can swiftly complete purchases.

Security is paramount for payments. Personalized options like dynamic QR code payments offer enhanced protection to your customers. Each code is unique per transaction, thwarting fraud attempts. Dynamic QR payments also provide real-time transaction confirmation, so your customers can shop confidently with peace of mind.

In the past, large purchases often strain customers’ budgets. The in-trend buy-now-pay-later (BNPL) personalized payments allow your customers to split their purchases into manageable installments. Customers find high-cost items more affordable when they can pay for them over several months.

2021-2026 BNPL e-commerce spending in Southeast Asia countries forecast

Numerous BNPL providers offer transparent payment schedules, aiding customers in budgeting and curbing impulse buys. With minimal upfront payments, your customers have more budget for other expenses, enabling wiser spending and smarter buying decisions.

Additionally, customers receive immediate notifications on their mobile phone or email after each transaction. This keeps your customers informed of their spending activity, fostering greater transparency and trust.

Coming up next…

On our next blog, see how you can harness the power of personalized payments and how it can benefit your business.

Qashier offers multiple digital solutions, including QR code table ordering, table management (F&B), employee management, customer relationship management (loyalty programs), inventory management, data analytics, and track payments, in an all-in-one device.

Qashier promises a seamless setup within 10 minutes, without the need for technical expertise. It boasts a user-friendly interface that is simple for anyone to learn and use. If you require assistance, you’ll find 7 days-a-week responsive technical support from your local team.

Try the Qashier app for free on your own Android device! Speak to us to see if Qashier’s Smart POS can meet your business needs. Schedule a meeting with us here, or contact us at +63 917 QASHIER (7274437) (Whatsapp and Viber) or email at [email protected].