Qashier triumphs with two awards for Fintech categories at Singapore and Malaysia Technology Excellence Awards 2024

The company continues to set standards in the fintech space…

The company continues to set standards in the fintech space…

The company continues to set standards in the fintech space…

In the wake of the global pandemic, it has shaken things up in the way online and offline merchants interact with customers. Some changes have proven to be more than just temporary adjustments. A notable shift is how customers are still loving contactless payments. It is not a fad; contactless payments are here to stay and getting even more popular and booming faster than ever!

To all of the existing merchants! Join us to uncover the critical factors behind this financial revolution. Find out why contactless payments have firmly established their position as a fixture in our post-pandemic world. How ready are you to adopt contactless payment into your business?

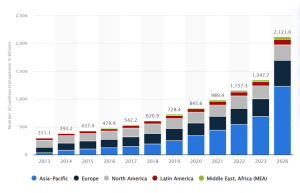

Contactless payments are not just a passing trend. Customers all across the world have embraced contactless payments effortlessly. In 2022, the user count in Southeast Asia exceeded 140 million, up from 137 million in 2021.

Statistics reveal that Singapore boasts the highest cashless payment adoption rate at 97%. In the meantime, Malaysia follows closely at 96%, Thailand at 94%, and the Philippines at 92%.

What are the primary responses to this direction? The key answers lay in the 3S of contactless payments – Speed, Security, and Saving.

One of the biggest draws for customers with contactless payments is the ease and lightning-fast tap to pay for a transaction. A quick tap or wave with a bank card or smartphone at the reader takes only 1-2 seconds.

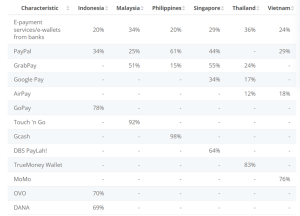

In 2022, the Visa Consumer Payment Attitudes Study reported that more than half of Southeast Asian consumers (53%) believe they can go cashless successfully for a week or longer. Some of the most successful countries in going fully cashless include Vietnam (average of 13.7 days), Malaysia (average of 12.9 days), and the Philippines (12.5 days).

Customers prefer the convenience of carrying only a bank card or a smartphone, avoiding the need for a bulky wallet and coin counting. It’s all about that lightweight, hassle-free feeling!

Moreover, it’s less time-consuming with contactless payment during peak shopping hours or long lunch queues. Customers can tap, pay, and be on their way in under 2 seconds. A faster checkout equals a smoother experience that saves time for both customers and merchants!

Undoubtedly, contactless payments are known for their enhanced security features, including encryption and tokenization. Such features effectively safeguard financial information from fraudsters.

For example, contactless cards generate a unique code for each transaction, unlike the traditional magnetic stripe cards. Furthermore, contactless payment reduces the risk of card skimming since it requires physical proximity when performing a transaction.

Customers paying with smartphones enjoy security as their devices require a PIN or password for authorized access. Advanced security features like Face ID and Touch ID on mobile devices enhance contactless payment methods.

Do you know contactless payments offer hidden bonus-cost savings for your customers? That’s right!

Banks and payment providers offer additional incentives when customers adopt contactless payments. For instance, one can receive 5% cashback for contactless transactions with certain credit cards.

Others include rewards redemption or discounts that encourage customers to switch from traditional payment methods. All these perks may add up to significant savings in the long run.

You should now get a better picture of why contactless payments are still popular. The number of customers using these payments allows merchants like you to equip themselves with the right payment solution to meet customer needs, and in turn, grow the business.

In a follow-up article, we’ll cover why merchants should embrace contactless payments and how Qashier can support you.

Qashier offers multiple digital solutions, including QR code table ordering, table management (F&B), employee management, customer relationship management (loyalty programs), inventory management, data analytics, and track payments, in an all-in-one device.

Qashier promises a seamless setup within 10 minutes, without the need for technical expertise. It boasts a user-friendly interface that is simple for anyone to learn and use. If you require assistance, you’ll find 7 days-a-week responsive technical support from your local team.

Try the Qashier app for free on your own Android device! Speak to us to see if Qashier’s Smart POS can meet your business needs. Schedule a meeting with us here, or contact us at +63 917 QASHIER (7274437) (Whatsapp and Viber) or email at [email protected].